Hybrid Car Rebate Alberta

Department of energy you can receive a tax credit of.

Hybrid car rebate alberta. You must have a federal tax liability in the year you purchase an electric car or plug in hybrid to claim the tax credit. A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles evs in the united states. According to the u s. The eligible vehicles include.

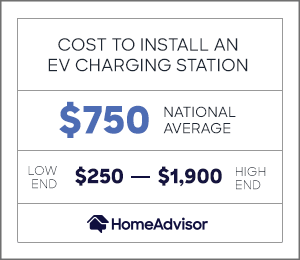

Dealers will reduce the vehicle by the incentive price you the consumer will have no additional paperwork and will receive the savings immediately. Electric vehicle home and workplace charging study. The tax liability must meet or exceed the amount of credit you re. The rebates take up to 5 000 off the cost of electric vehicles and 2 500 off of plug in hybrids for vehicles that have a starting msrp 45 000 and whose higher vehicle trims does not exceed 55 000.

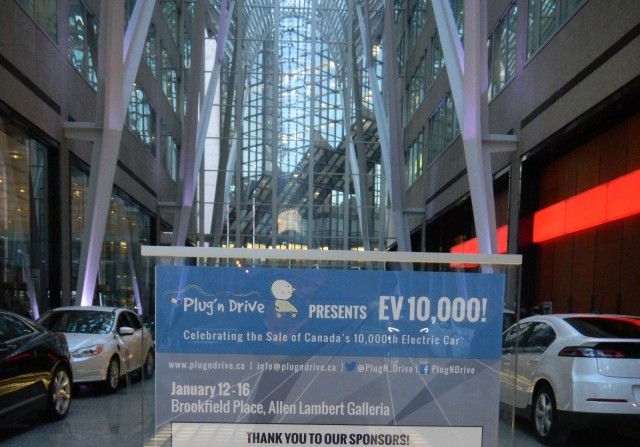

State and or local incentives may also apply. On may 1 2019 a new federal rebate took effect to encourages drivers to purchase electric vehicles. It builds upon the city of calgary s climate resilience strategy and the city of edmonton s energy transition strategy which call for increased ev adoption to meet their climate and. The electric vehicle home and workplace charging study assessed opportunities to accelerate the deployment of ev charging infrastructure across alberta.

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500. Find the best hybrid discounts and current offers. Story continues below advertisement. Administered by cse for the california air resources board the clean vehicle rebate project cvrp offers up to 7 000 in electric vehicle rebates for the purchase or lease of new eligible zero emissions and plug in hybrid light duty vehicles.

Audi a3 e tron 2 500 chevy bolt and volt 5 000 chrysler pacifica hybrid 5 000 ford fusion energi 2 500 ford focus ev 5 000 honda clarity phev 5 000.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/YWEN4H572NC4DHAKJWMXWNXBYA.jpg)